Breaking News

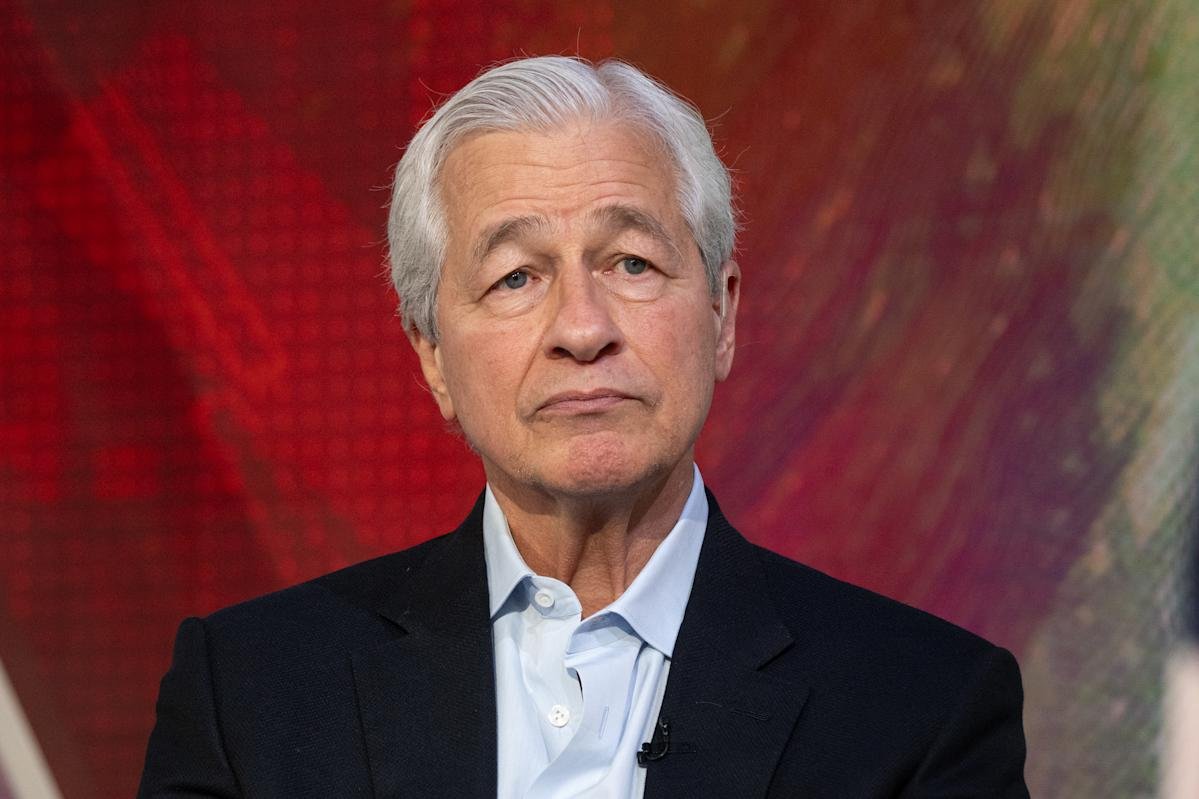

Wall Street credit worries intensify after Dimon’s ‘cockroach’ warning

Wall Street’s credit worries are intensifying after a warning from JPMorgan Chase (JPM) CEO Jamie Dimon about cockroaches in the US economy. Investors on Thursday punished the stocks of regional banks and an investment bank exposed to the bankruptcy of an auto parts maker.

The regional banks that plummeted Thursday were Phoenix-based Western Alliance Bancorporation (WAL) and Salt Lake City’s Zions Bancorporation (ZION). Zions’ stock fell 13% and Western Alliance’s stock fell nearly 10%.

Their pullbacks came after Zions on Wednesday said it took a $50 million charge-off — a measure of unpaid debt written off as a loss — for two business loans extended through its California Bank & Trust division.

The regional bank said it made the decision after it “became aware of legal actions initiated by several banks and other lenders” affiliated with two of its borrowers and an internal review of its own portfolio.

The drop in Western Alliance came after it said on Thursday that it filed a lawsuit “alleging fraud by the borrower” over a revolving credit facility to an entity called Cantor Group V LLC.

The disclosures are the latest in a series of developments that have worried Wall Street as investors look for signs that credit among commercial customers is weakening.

The concerns started with two recent and sizable bankruptcies in September: subprime auto lender Tricolor and larger auto parts supplier First Brands.

A spokesperson for Western Alliance said its disclosure “was not related to First Brands or TriColor and is an isolated credit incident.” Zions Bank did not immediately respond to a request for comment.

The aftermath revealed a web of exposures among large Wall Street players, including Jefferies Financial Group (JEF). A fund controlled by Jefferies’ asset management unit has $715 million in receivables owed by First Brands customers, according to court filings published earlier this month.

Executives have been trying to assure investors that the impact on the firm will be manageable.

The company published a letter to shareholders from Jefferies CEO Richard Handler and president Brian Friedman, noting that Jefferies’ exposure was “readily absorbable” and that the impact to the company’s stock and credit perception was “meaningfully overdone.”

The firm’s investment exposure is effectively “$43 million in accounts receivable” and “$2 million of interest on First Brands’ bank loans,” the executives said.

Yet, investors still sent the company’s stock down more than 10% Thursday.