Breaking News

Bitcoin Heading for Worst Month Since Crypto Collapse of 2022

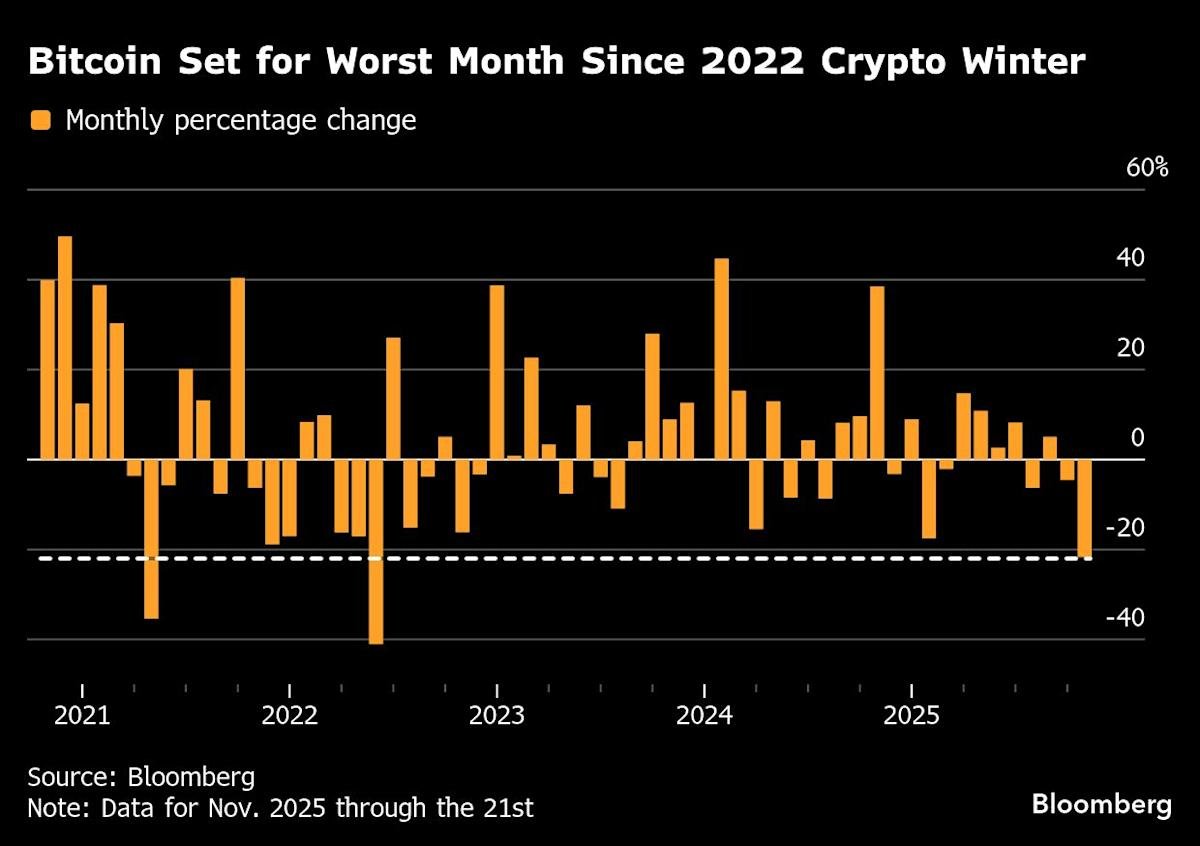

(Bloomberg) — Bitcoin is on track for its worst monthly performance since a string of corporate collapses rocked the wider crypto sector in 2022.

The largest cryptocurrency slid as much as 7.6% to $80,553, before paring losses on Friday. Runner-up Ether fell as much as 8.9% to below $2,700 and a host of smaller tokens nursed similar declines. The total market value of virtual coins dropped below $3 trillion for the first time since April, data from CoinGecko show.

Most Read from Bloomberg

Bitcoin has now shed about a quarter of its value in November, the most for a single month since June 2022, according to data compiled by Bloomberg. The implosion of Do Kwon’s TerraUSD stablecoin project in May of that year sparked a daisy chain of corporate failures that culminated in the downfall of Sam Bankman-Fried’s FTX exchange.

Despite a pro-crypto White House under US President Donald Trump and surging institutional adoption, Bitcoin has plummeted over 30% since rocketing to a record in early October. The rout follows a crippling bout of liquidations on Oct. 10 that wiped out $19 billion in leveraged token bets, and in turn erased roughly $1.5 trillion from the combined market value of all cryptocurrencies.

“The convergence of forced liquidations and structural ETF selling has pushed the market into a particularly vulnerable state where any attempt at stabilization faces immediate supply from multiple sources,” said Chris Newhouse, director of research at Ergonia, a firm specializing in decentralized finance.

The selling pressure has intensified in the past 24 hours, with a further $2 billion in leveraged positions liquidated, according to data from CoinGlass.

The broader market backdrop has done little to help. US stocks, which had rallied on renewed enthusiasm for artificial intelligence after upbeat earnings from Nvidia Corp., surrendered gains late Thursday amid concerns over stretched valuations and doubts about a Federal Reserve rate cut in December. Stock prices continued to whipsaw investors Friday.

“Sentiment across the board is incredibly poor. There appears to be a forced seller in the market and it is unclear how deep this goes,” said Pratik Kala, portfolio manager at Australia-based hedge fund Apollo Crypto.

A crypto wallet labeled “Owen Gunden” that’s held Bitcoin since 2011 started selling a total $1.3 billion worth of the token in late October, and divested its last Bitcoin on Thursday, according to an X post from blockchain researcher Arkham Intelligence.

Story Continues