US Politics

Trump announces $200 billion purchase in mortgage bonds to lower housing costs

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it’s investigating the financials of Elon Musk’s pro-Trump PAC or producing our latest documentary, ‘The A Word’, which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.

Read more

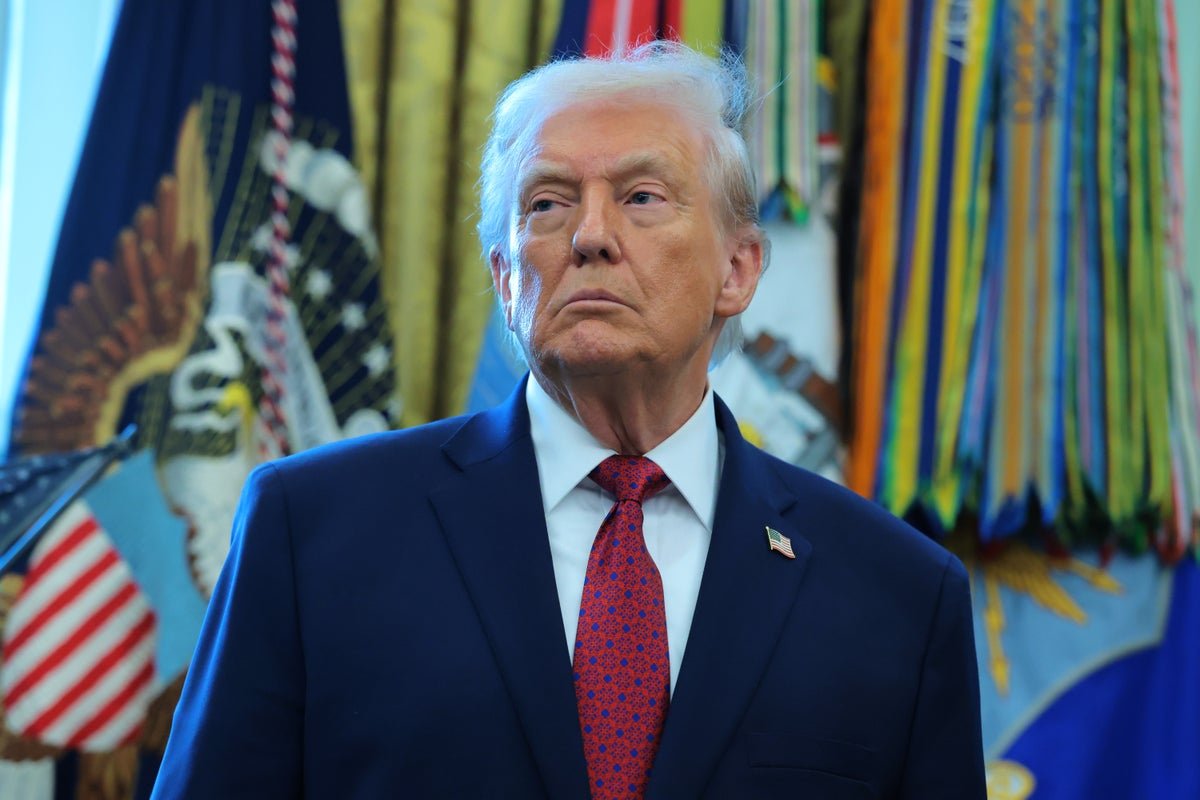

Donald Trump has announced that he is directing the federal government to purchase $200 billion in mortgage bonds, a move he claims will significantly lower mortgage rates and ease the burden of homeownership.

The announcement, made on social media on Thursday, comes as the White House seeks to address growing voter anxieties over housing affordability in the run-up to November’s midterm elections. The funds for this substantial purchase are expected to come from Fannie Mae and Freddie Mac, the two mortgage companies currently operating under government conservatorship, which reportedly hold $200 billion in cash reserves.

Trump asserted that the initiative “will drive Mortgage Rates DOWN, monthly payments DOWN, and make the cost of owning a home more affordable.”

The challenge of housing affordability, marked by home prices generally outpacing income growth due to a persistent construction shortage, has been a significant concern since Trump’s first term, making it difficult for first-time buyers and existing homeowners looking to upgrade.

White House officials did not immediately respond to questions about the timelines for how purchases would be funded. The Federal Reserve has in the past bought mortgage bonds during times of economic turmoil in order to help reduce interest rates.

There is roughly $2 trillion worth of mortgage-backed securities on the Fed’s balance sheet. That’s down from $2.7 trillion in June of 2022, when the annual inflation rate hit a four-decade high and mortgage rates climbed to levels that increased monthly payments for homebuyers.

The average 30-year fixed rate mortgage was about 6.2 percent on Thursday, down from nearly 7 percent when Trump took office, according to Freddie Mac, a mortgage company that has been under government conservatorship since the 2008 global financial crisis.

When the interest rate falls, it can become cheaper to service the debt on a monthly basis and affordability can improve for a period until home prices adjust in response to changes in the rates. There was roughly $21.1 trillion in outstanding mortgage debt as of the middle of last year, according to the St. Louis Federal Reserve.

Many homeowners took advantage of low interest rates during the pandemic to refinance their mortgages at rates of 3% or lower.

Trump last month said he planned to unveil housing reforms — and on Wednesday he said he wants to block institutional investors from buying houses.