Daily Agenda

Consumer Spending Slows as Tariff Fears Grip Americans

WASHINGTON D.C. – American consumers are tightening their purse strings, curbing spending on discretionary items like dining out, travel, and even cosmetic procedures, as they brace for the impact of impending tariffs and persistent economic uncertainty. Data released Friday paints a picture of a cautious populace, with savings rates on the rise and consumer sentiment waning.

According to government figures, consumer spending, adjusted for inflation, edged up a meager 0.1 percent in February, a stark contrast to the 0.6 percent decline observed in January. Simultaneously, the personal savings rate climbed to 4.6 percent, indicating a growing inclination to save rather than spend.

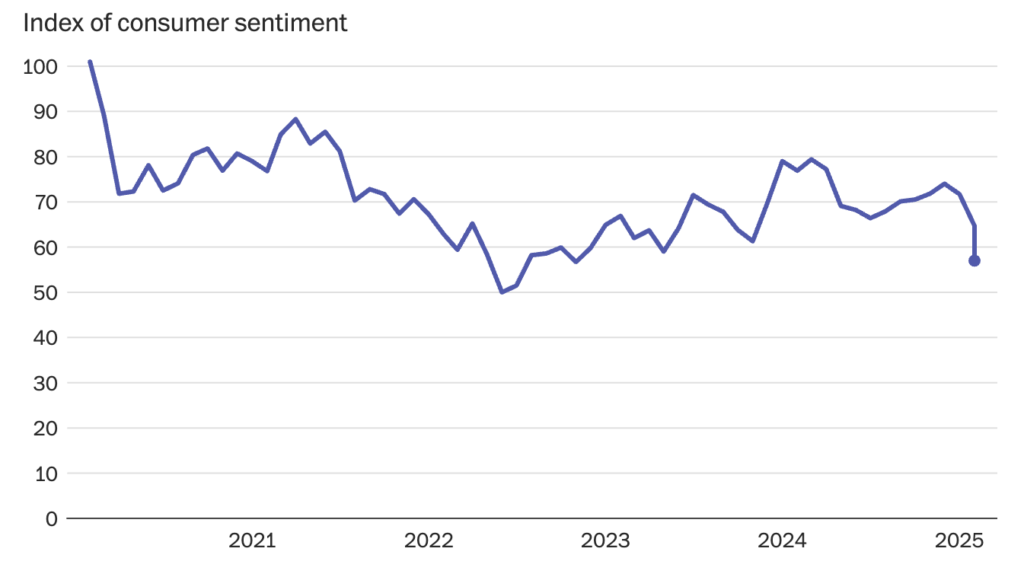

Adding to the economic unease, a University of Michigan survey revealed a third consecutive month of declining consumer sentiment, reaching its lowest point since 2022. This drop reflects growing anxieties surrounding the economy, particularly in anticipation of price hikes triggered by new tariffs set to take effect this week.

“Consumers are increasingly apprehensive about spending,” stated Lydia Boussour, senior economist at EY-Parthenon. “We are seeing clear signs that people are being more careful—they’re reluctant to spend on nonessential expenses. They’re worried about inflation and have preemptive anxiety around tariffs.”

The slowdown is not limited to lower-income households. Economists are observing a notable shift in spending habits across all income brackets, including the wealthiest. This development is particularly significant, as the top 10 percent of earners, with annual household incomes exceeding $250,000, have been pivotal drivers of the post-pandemic economic expansion. According to calculations by Moody’s Analytics for the Wall Street Journal, these high-earning households account for a substantial 49.7 percent of all U.S. spending.

This widespread pullback in consumer spending is expected to exert downward pressure on economic growth in the first quarter of the year. Many economists are now forecasting a potential contraction, marking a significant shift after years of sustained growth. The looming tariffs, coupled with existing inflationary pressures, are fostering a climate of uncertainty, prompting Americans to prioritize savings over discretionary spending.